Central bank balance sheet is one of the forms of reporting by the central bank of the country, which reflects the state of its allocated, borrowed, and owned funds as of a certain date.

The central banks of most countries in the world calculate and publish balance sheet data on a monthly basis (for example, in

Austria,

Japan,

Poland,

Russia,

Luxembourg,

the Netherlands, and

Mongolia). In a number of countries, the central bank balance sheet is published quarterly (for example, in

Estonia) and weekly (in

Australia,

Eurozone,

UK, and the

USA).

Today, the balance sheet is actively used by central banks in their monetary policy, in particular, in the formation of its transmission mechanism.

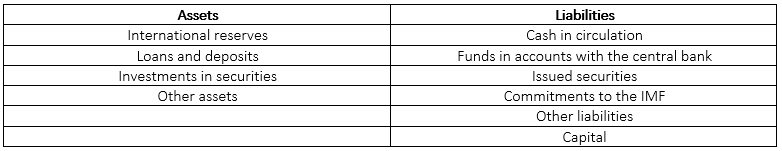

The central bank’s balance sheet consists of two parts: assets and liabilities. The table below shows the classic structure of a country’s central bank balance sheet.

In terms of the composition of assets, first of all, foreign exchange reserves should be noted. These include monetary gold, foreign exchange funds, special drawing rights (SDRs), and a reserve position in the IMF.

Switzerland,

Russia,

Denmark,

Portugal,

Greece,

Hungary, and

Germany can be cited as examples of countries whose foreign exchange reserves are part of the assets of the central bank.

Loans and deposits in assets include loans granted to banks and state corporations, as well as deposits placed by the Central Bank. Investments in securities analyze the investments of the central bank in various types of financial instruments, for example, in government debt.

Other assets may include fixed assets on the balance sheet of the central bank, as well as advance payments of income tax.

The liabilities of central banks include cash in circulation, that is, banknotes and coins issued by the Central Bank. Funds in accounts with the central bank primarily include deposits of credit institutions, funds of state authorities (for example, the government), and required reserves of banks. Liabilities also include securities issued by central banks. For example, in

South Korea, these are

bonds of the Bank of Korea; in

the Russian Federation, these are

bonds of the Bank of Russia). Liabilities to the IMF include balances in the IMF’s accounts with the central bank. Other liabilities include liabilities of the central bank to the budget, pension funds, etc. The capital of the central bank includes the authorized capital, the reserve fund, and the profit/loss of the reporting period and previous years.

In recent years, central bank balance sheet figures have been growing the most in the US, UK, Eurozone, and Japan. The graph below shows the dynamics of the balance values of the central banks of these countries, starting from 2016 (data are given in normalized values).

.png)

The graph shows an acceleration in the expansion of central bank balance sheets amid new quantitative easing programs adopted to mitigate the 2020 crisis.

Bond Screener

Watchlist

Excel add-in

API

.png)