Equity is the residual interest in a company’s

assets after deducting all of its

liabilities. This definition of capital is given in the Conceptual Framework for Financial Reporting under IFRS.

The equity capital of an organization includes the following components:

1. Authorized capital. This is the amount that owners invest when creating an organization. If we are talking about

issuers of shares, then this is the nominal value of all shares that were acquired by the shareholders of the company.

2. Retained earnings. This is the part of the company’s profit that was not paid out to shareholders as dividends. If the company suffers losses in the reporting period, then the company indicates an uncovered loss, reflecting the total amount of losses that were not covered by the organization at its own expense.

3. Additional capital is a part of the capital that is formed from sources not related to the company’s operating activities, for example, share premium from the sale of shares, revaluation of non-current assets, and exchange rate differences.

4. The company’s own shares, repurchased from shareholders. Here we are talking about shares that are bought back by the company, for example, in the case when the company’s management considers them undervalued.

5. Capital attributable to the owners of the parent company.

6. Minority interest (non-controlling interest) is a share that belongs to minority shareholders and does not give them the ability to control the activities of the company.

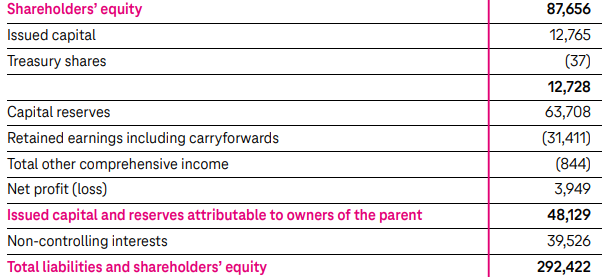

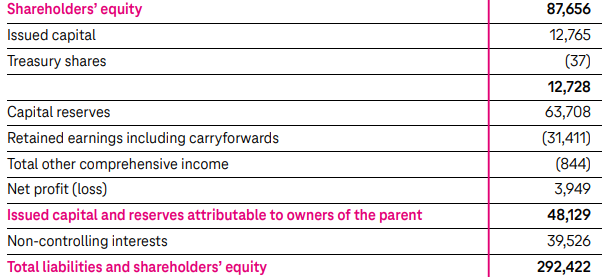

Using the example of

Deutsche Telekom IFRS statements for the

1st quarter of 2022, you can see the structure of the company’s equity.

As part of

IFRS reporting, capital, together with assets and liabilities, is reflected in the statement of the financial position of the organization.

In reporting according to local standards, for example,

RAS, equity is disclosed as part of the organization’s balance sheet (where the corresponding section is called "Capital and reserves").

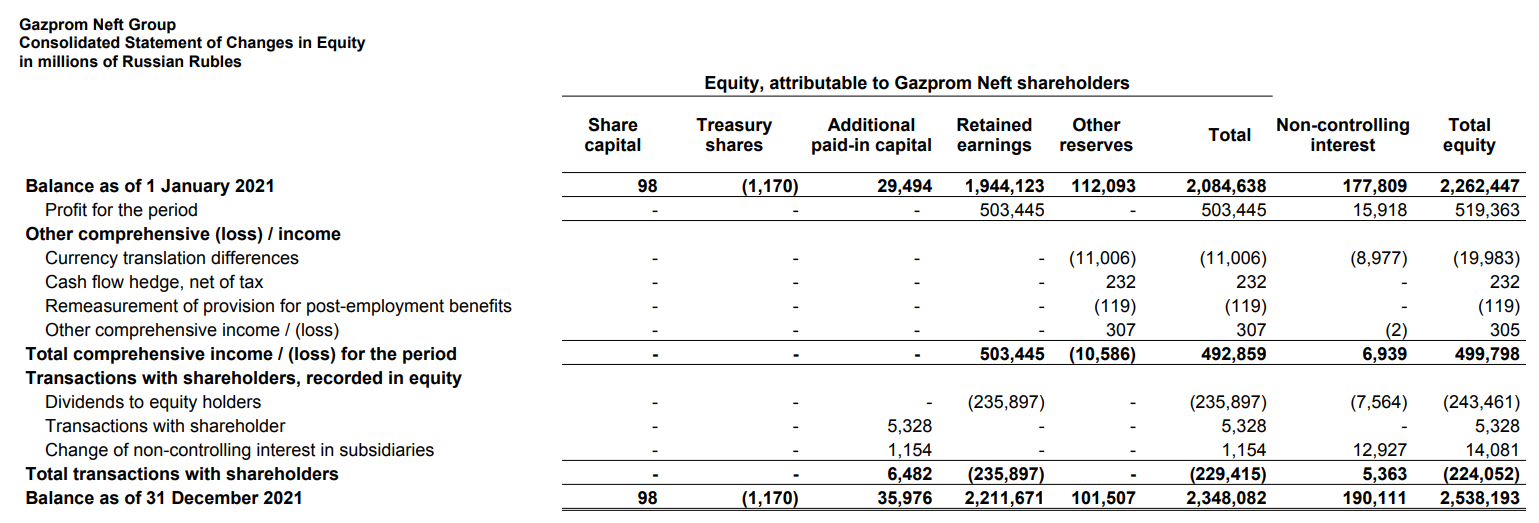

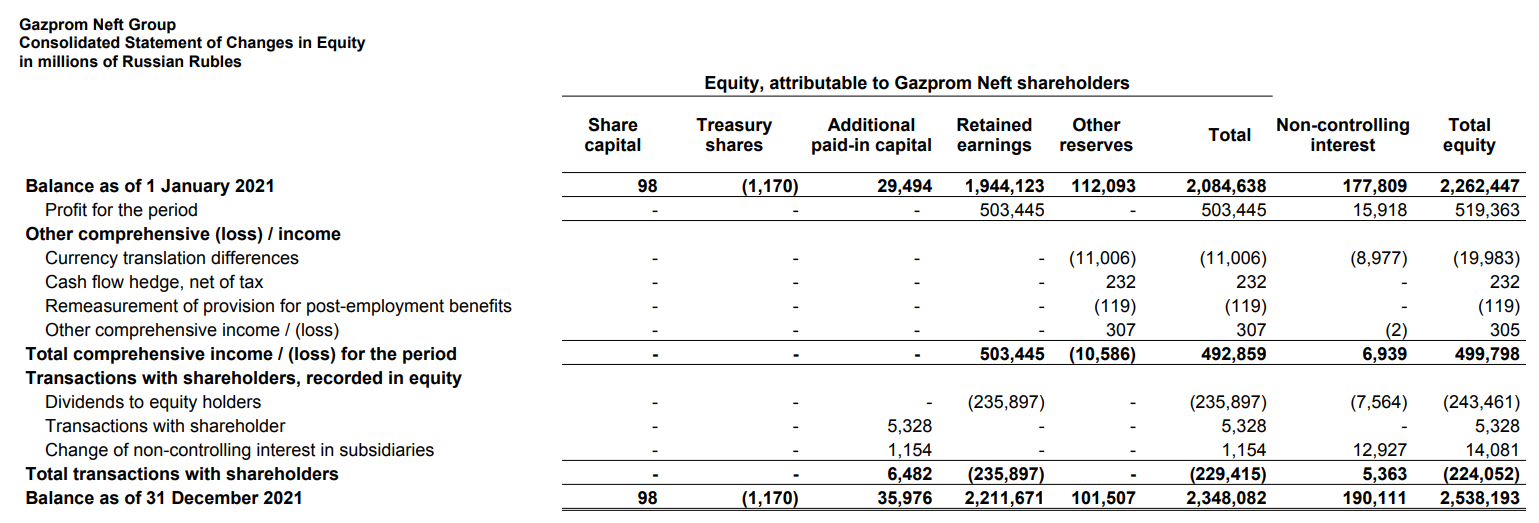

In addition, in the reporting prepared in accordance with international standards, as well as in accordance with a number of local standards, a report on changes in equity is provided, which reflects information on the increase and decrease in the company’s capital for a certain period. This report reveals the structure and reasons for changes in the organization’s own funds.

On the example of the issuer

Gazprom Neft, you can get acquainted with what the statement of capital flows in IFRS looks like.

Bond Screener

Watchlist

Excel add-in

API