IFRS (International Financial Reporting Standards) is a set of rules and principles for accounting and financial reporting by companies in the course of their activities.

IFRS standards began to appear in 1973, when the International Accounting Standards Board was created, which was transformed into the International Standards Board in 2001. In

Russia, such standards began to be introduced gradually in the late 1990s and early 2000s.

The main purpose of the introduction of IFRS is to simplify the international comparison of company reporting, as reporting standards in different countries of the world may differ. The key difference between IFRS and national standards, for example,

RAS, is that they establish only the basic principles for the formation of corporate reporting and do not contain primary documentation, accounting entries, or a strict chart of accounts.

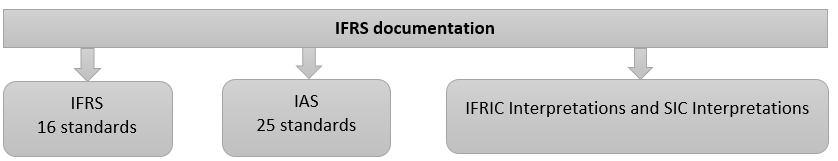

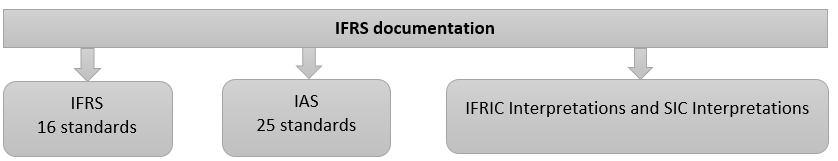

International Financial Reporting Standards have the following structure.

The main difference between IFRS and IAS is that IAS was developed and adopted by the IFRS Committee, while IFRS was developed by the IASB.

According to IAS 1 "Presentation of Financial Statements" reporting under international standards includes:

1) Statement of financial position

2) Statement of profit or loss and other comprehensive income

3) Statement of changes in equity

4) Cash flow statement

5) Notes

At the same time, there are consolidated and separate financial statements. In the consolidated financial statements, the assets, liabilities, income, expenses, and cash flows of the parent company and its subsidiaries are presented as belonging to one company. The principles for compiling such reporting are spelled out in IFRS 10.

In turn, an entity may account for its investments in subsidiaries, joint ventures, and associations in its separate financial statements at cost or under the equity method of its choice. The procedure for preparing separate financial statements is regulated by IAS 27.

There are about 170

countries which use IFRS. Examples of issuers that have IFRS accounts include

Volvo,

Commerzbank,

Siemens,

Equinor,

Axtel,

KazTransGas,

Mosenergo, and

Akbank.

The

United States currently has its own US GAAP financial reporting standards, which are very similar to IFRS standards. There are differences related to the presentation of financial statements, fair value measurement, accounting for leases, and financial instruments. For example, in US GAAP, the statement of changes in equity can be published as a separate statement or as part of the notes to the financial statements. Examples of US companies that publish US GAAP accounts are

Apple,

Morgan Stanley,

Intel,

Adobe, and

Biogen.

Bond Screener

Watchlist

Excel add-in

API