Income and expenses are the elements of an organization’s financial statements that are directly related to the measurement of its profits. This treatment of income and expenses is provided in the

IFRS Conceptual Framework for Financial Reporting.

Income represents an increase in

assets or a decrease in

liabilities that lead to an increase in equity. The increase in

equity is not connected with the contributions of its participants (shareholders).

Income includes revenue and other income. Revenue arises in the course of the ordinary activities of the entity, while other income may be received not only in the course of current activities. Other income includes, for example, profit from the disposal of non-current assets. Revenue can go by various names, such as sales revenue, interest, dividends, royalties, rents, or service fees.

Expenses, in turn, are understood as a decrease in assets or an increase in liabilities, the consequence of which is a decrease in the equity capital of the company, which is not related to the distribution among its participants.

The company’s expenses include expenses arising in the course of ordinary activities, such as the cost of sales, labor costs, depreciation, as well as various types of losses (e.g., from natural disasters, the disposal of non-current assets, or changes in the exchange rate).

According to international standards, despite the fact that income and expenses arise from changes in the value of assets or liabilities of the company, information about them is no less important than data on assets and liabilities.

Profit, which is also indicated in the financial statements of the issuer, is a reflection of the financial results of its activities.

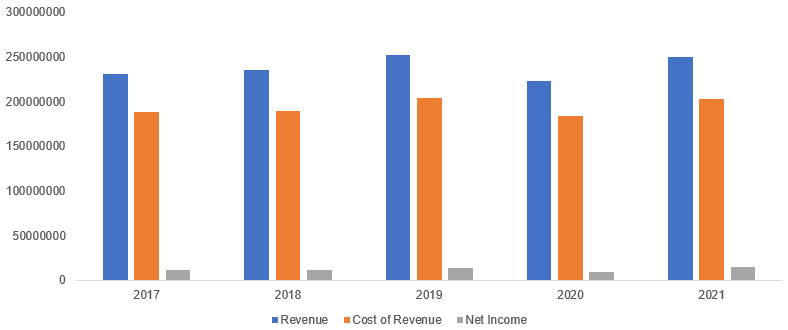

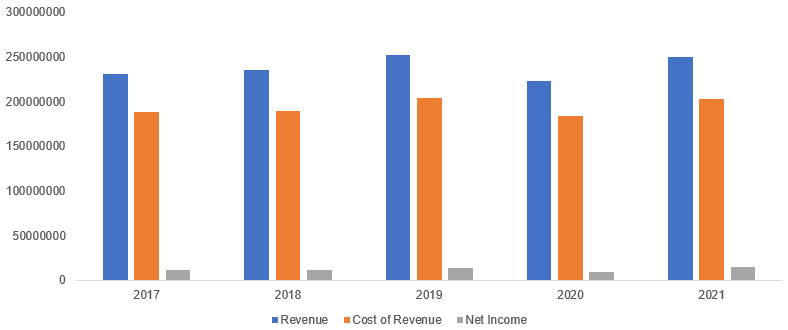

An entity’s income and expenses are presented in the statement of profit or loss and other comprehensive income, which is prepared and presented in accordance with IAS 1 Presentation of Financial Statements. Based on the data in this report, for example, you can analyze how the revenue, cost, and net profit of the German company

Volkswagen have changed over the past five years (data are presented in thousands of EUR).

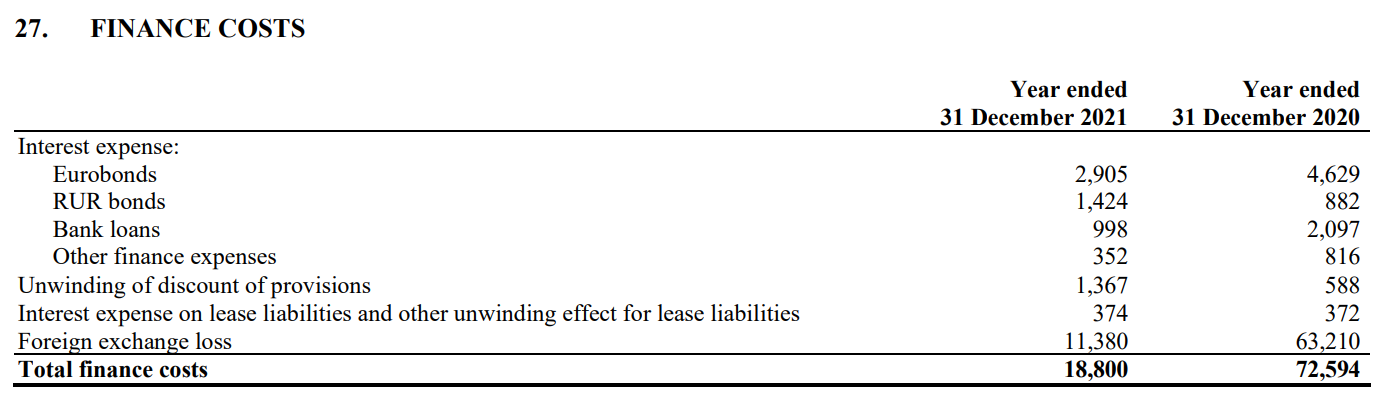

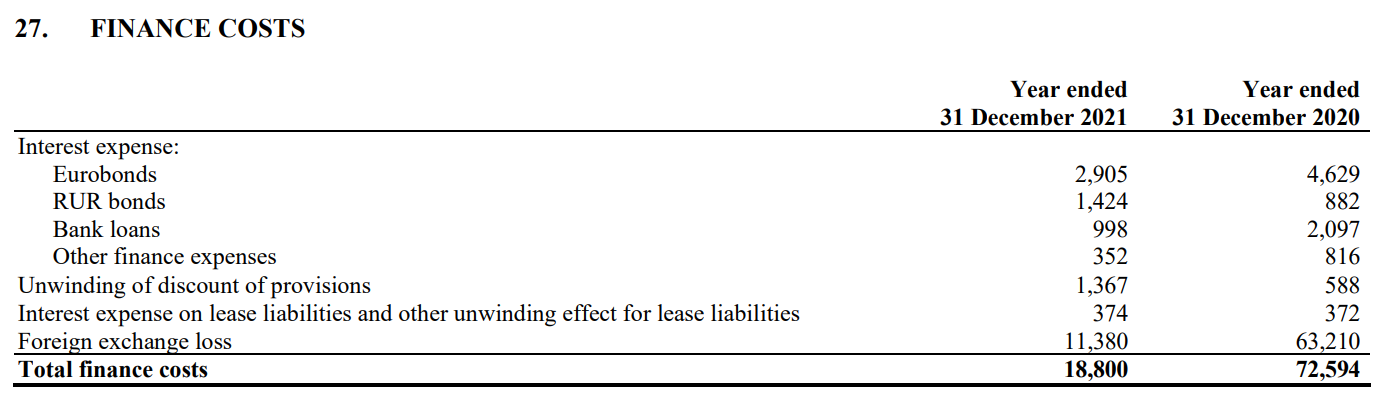

It’s good to keep in mind that the notes to a company’s financial statements typically provide a detailed breakdown of its income and expenses.

So, using the example of

ALROSA financial statements for 2021, you can get acquainted with the structure of its financial expenses, which include, in particular, interest expenses on its

bonds and eurobonds.

Bond Screener

Watchlist

Excel add-in

API