NRA (National Rating Agency) is a Russian rating agency based in Moscow. The agency’s official website is available at the link -

https://www.ra-national.ru/en/.

NRA is a rating agency accredited by

The Bank of Russia and has been registered as a credit rating agency since September 2019.

The National Rating Agency assigns credit ratings according to the National Credit Rating Scale for the Russian Federation. Ratings are assigned to companies in the corporate sector from various industries, specifically:

1) Credit institutions (for example,

Altaicapitalbank,

Dalnevostochny Bank,

SME Bank,

MTI-Bank, and

Rusnarbank)

2) Non-financial companies (

ChimTech,

Naphtatrans Plus,

Commercial Real Estate Garant-Invest,

Seligdar, and

Reinnolts)

3) Investment and financial organizations (

Dominion)

4) Leasing companies (

RG Leasing and

Royal Capital)

5) Insurance companies (for example,

AMT-Insurance,

AlfaStrakhovanie,

SOGLASSYE Insurance,

Maks Life Insurance, and

EUROINS)

The agency also assigns issue ratings according to the National Rating Scale. As of May 2022, only the

001P-05 and

002Р-03 series of Commercial Real Estate bonds of FPK Garant-Invest have NRA ratings.

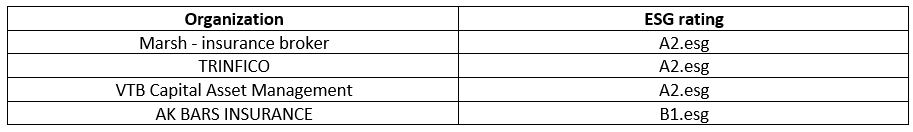

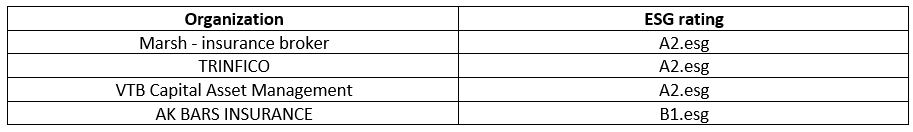

The NRA assigns ESG ratings to evaluate a company’s sustainability performance. Ratings are assigned on a scale from A1.esg (the highest rating) to C.esg (the lowest rating). The table below shows companies with ESG ratings from the NRA (as of May 2022).

The agency also assigns non-credit ratings to depositories, investment companies, NPFs, registrars, and management companies, as well as ratings of reliability and investment attractiveness of closed-end mutual funds.

The NRA prepares and publishes releases on the assignment, change, confirmation, or withdrawal of ratings of companies and bonds, as well as different kinds of analytical materials in certain areas (banking, macroeconomics, oil and gas, retail, agriculture, insurance, electricity, etc.).

Bond Screener

Watchlist

Excel add-in

API