20-F is an annual reporting form that is compiled and disclosed by private foreign companies that hold shares on US exchanges. Under US law, issuers are required to disclose this reporting form within four months of the end of the reporting period (year). Data from 20-F forms are published on the official site of the US Securities and Exchange Commission.

Companies that are not from the USA or Canada report based on the form above since US companies have their own mandatory reporting form (10-Q and 10-K), and Canadian companies have their own (40-F).

Companies with less than 50% of voting shares owned by US investors are eligible to report under the 20-F form. As soon as the organization no longer meets the criterion, it must publish its financial results on Form 10-Q and 10-K and bring its financial statements in line with US GAAP requirements.

The primary purpose of Form 20-F is to standardize and unify the disclosure requirements of foreign issuers so that investors can analyze their activities alongside US companies.

As part of the 20-F form, companies typically present balance sheets, income statements, changes in equity, and cash flow and disclose the results of their activities for the past financial year.

Examples of the companies that disclose under Form 20-F include Lloyds Bank, Stellantis, UBS Group, JE Cleantech Holdings, Kamada, Golden Ocean Group, and EuroDry.

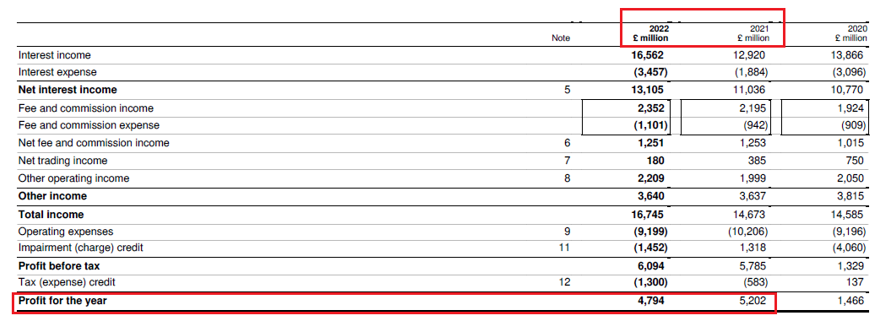

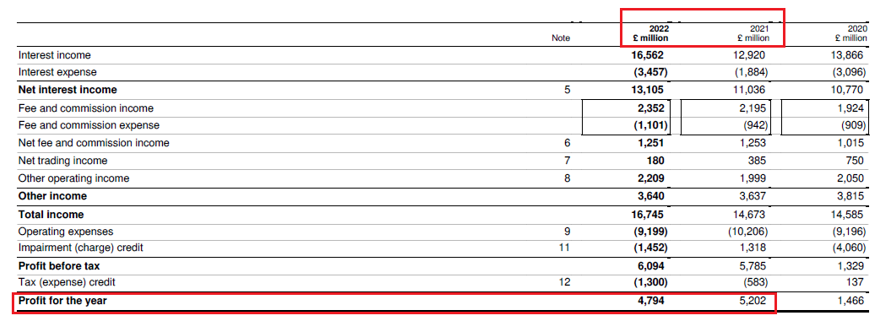

For example, Lloyds Bank’s financial year coincides with the calendar year and finishes at the end of December. As of December 31, 2022, the bank’s consolidated F-20 financial statements show that its net income for 2022 was 7.84% lower than in 2021, at £4,794 million.

In addition to the financial statements, Form 20-F discloses other information that relates to the company’s activities, such as business reviews, corporate governance, listing and dividend information, currency control, risk factors, forecasts, etc.

Bond Screener

Watchlist

Excel add-in

API