40-F is an annual reporting form established by US law under which Canadian companies that have securities registered in the United States report. 40-F reporting is published on the SEC site, as are other similar reporting forms (10-K, 10-Q, 20-F).

A company is required to publish 40-F form financial statements if it:

1) is registered under Canadian law;

2) is a private issuer of securities;

3) has an outstanding stock of 75 million USD and above;

4) reported on its activities to Canadian regulators for at least the past 12 months;

5) is not an investment company.

Examples of public issuers that disclose the 40-F annual report are the Bank of Nova Scotia, Baytex Energy Corp, Royal Bank of Canada, Rogers Communications, Theratechnologies, Westport Fuel Systems, and Wheaton Precious Metals Corp.

The 40-F contains all the standard forms of reporting (balance sheet, income statement, changes in equity and cash flow, and corresponding notes), as well as a review of the company’s activities, strategy, competitive advantages, and a risk analysis. In this form, the company details all the information that may be interesting and necessary to its stakeholders in the United States.

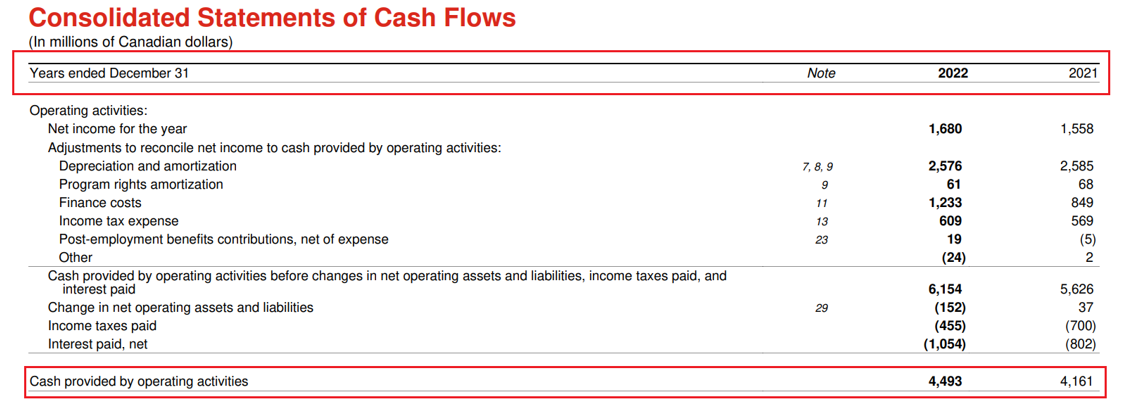

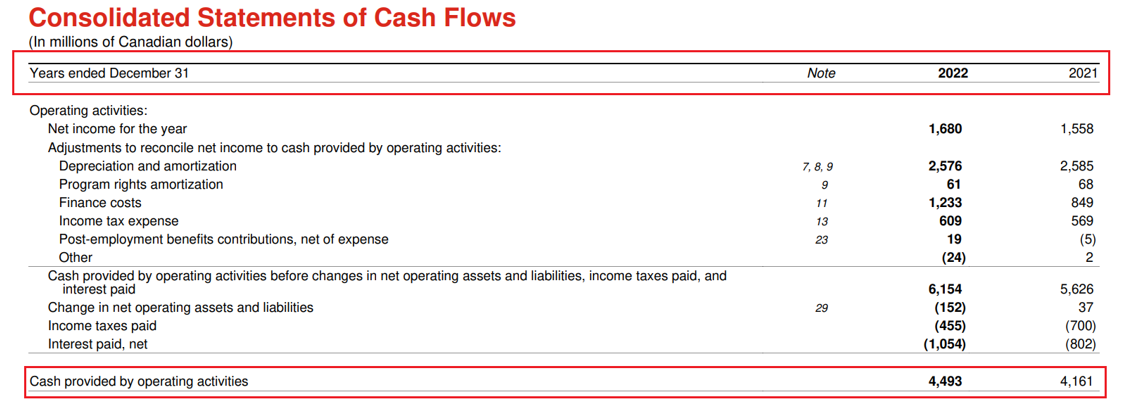

For example, the Rogers Communications Cash Flow Report can show that in 2022, the company received 4,493 million Canadian dollars as part of its operations, which is 7.9% more than in 2021.

In structure and content, the 40-F form is similar to the 10-K form, under which companies from the United States report annually on their activities.

It should be noted that in Canada, there are a number of companies that do not meet the required criteria and report on forms 10-Q, 10-K and 20-F, for example, Edesa Biotech, Worksport, Sphere 3D, and FSD Pharma.

In Canada, International Financial Reporting Standards (IFRS) are mandatory. This is an advantage for Canadian companies as the SEC recognizes IFRS as equivalent to the US GAAP standards. Therefore, organizations that plan to place securities in the United States do not need to transfer their statements from IFRS to US GAAP.

Bond Screener

Watchlist

Excel add-in

API