Cash flow is the receipt and disposal of the company’s funds for a certain period of time, which occur when it carries out different types of activities.

In the financial statements under

IFRS and local standards, for example,

RAS, information on the company’s cash flows is disclosed as part of the cash flow statement. This form of reporting, as a rule, presents data on three types of cash flows of the company:

1.

Cash flows from operating activities. This is the cash flow within the current (operating) activities of the company. It is considered the main cash flow. It includes receipts from the sale of goods and services, rent, as well as payments to suppliers and contractors, labor costs, and income tax.

2.

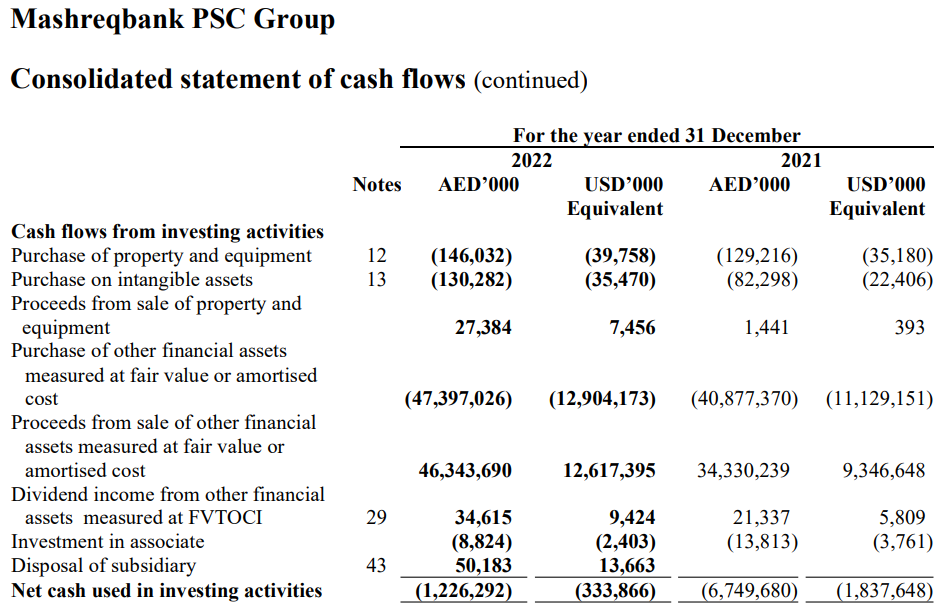

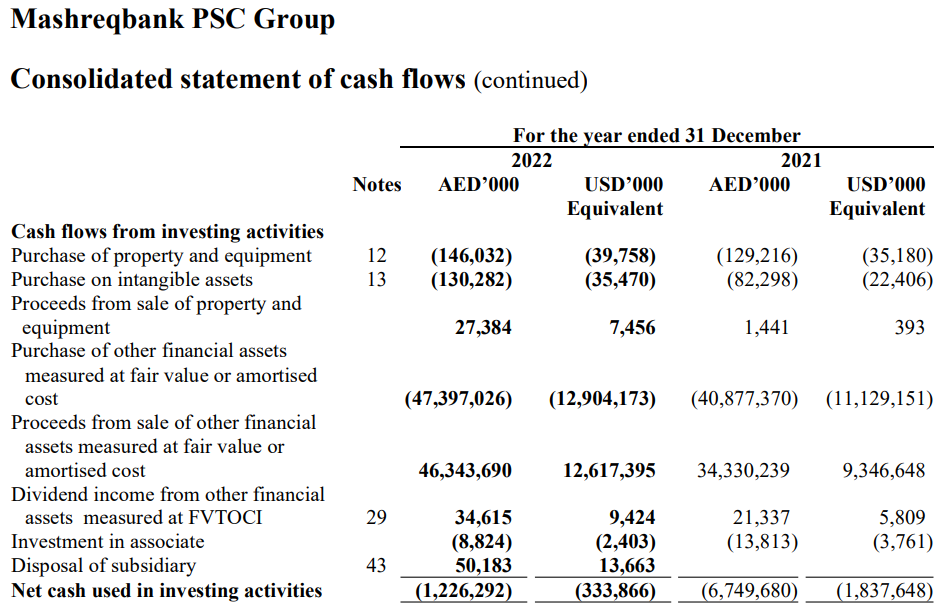

Cash flows from investing activities. It includes income from investment activities (for example, from the sale of fixed assets and intangible

assets, the sale of stocks and bonds, from the repayment of loans, dividends received), as well as investments in non-current assets and securities (stocks,

bonds).

3.

Cash flows from financing activities. The cash flow from the financial activities of the organization includes proceeds from the issuance of bonds, from the receipt of loans, as well as the payment of dividends, payments related to the repayment of debt securities, with the repayment of loans.

Companies also analyze

net cash flow (NCF), which is the difference between the receipt and disposal of a issuers funds when it performs a specific activity.

Accordingly, net cash flow can be positive and negative. If the indicator is higher than 0, it indicates that the company has enough money to pay its obligations to counterparties, if it is lower than 0, it indicates insufficient funds.

Cash flow is an important indicator of the investment attractiveness of the company. In addition, the net cash flow from operating activities is used in the calculation of

free cash flow.

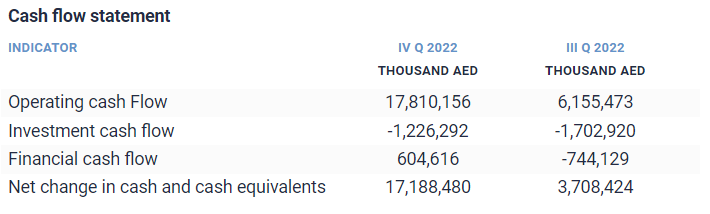

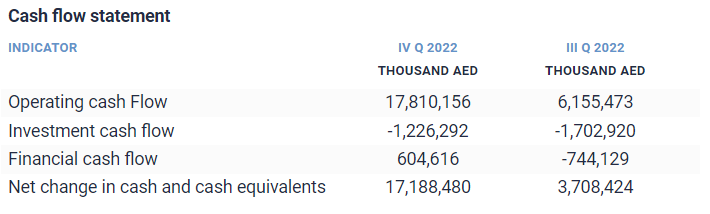

Below are the data on the cash flows of

Mashreqbank for the last 2 reporting periods of 2022.

A more detailed structure of the cash flows of this bank is presented in its

consolidated financial statements.

Bond Screener

Watchlist

Excel add-in

API