Loan portfolio is the balance of all loans that the bank has issued to individuals and entities, calculated on a specific date. The loan portfolio is one of the reporting indicators that are part of the assets of a credit organization.

The financial statements of banks reflect the gross loan portfolio, which represents the total volume of loans issued to customers on a specific date, and the net loan portfolio, calculated as the difference between the gross loan portfolio and the amount of loan loss provisions (LLP), which are formed by the bank in case of possible default or improper performance by borrowers of their obligations to repay the debt.

The bank’s loan portfolio can be calculated both on the basis of IFRS reporting and on the basis of information in the reporting compiled according to local standards.

Information on the bank’s net loan portfolio in IFRS reporting is reflected as assets in the statement of financial position of a credit institution.

For example,

Sberbank of Russia publishes this indicator under the title "Loans and Advances to Customers".

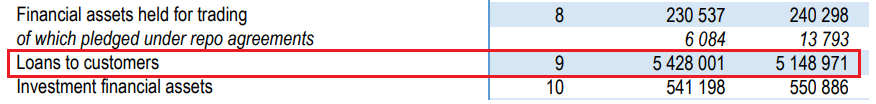

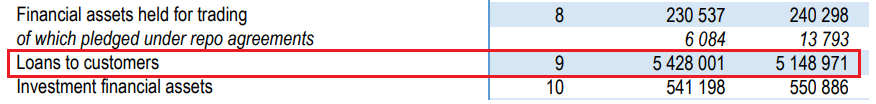

Gazprombank

Gazprombank net loan portfolio indicator is reflected in the line "Loans to customers".

In the IFRS statements of

Bank FC Otkritie, this indicator is also called "Loans to customers".

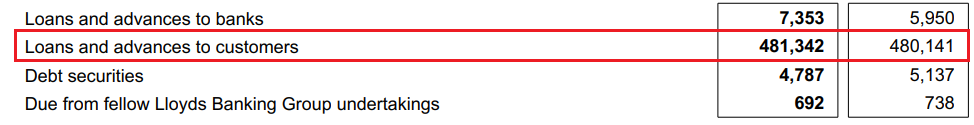

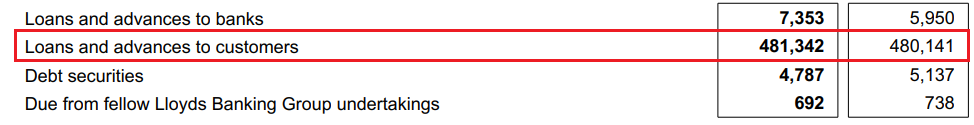

Lloyds Bank

Lloyds Bank reports net loan assets in portfolios as "Loans and advances to customers".

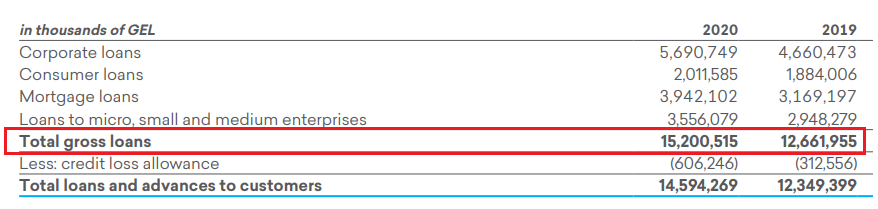

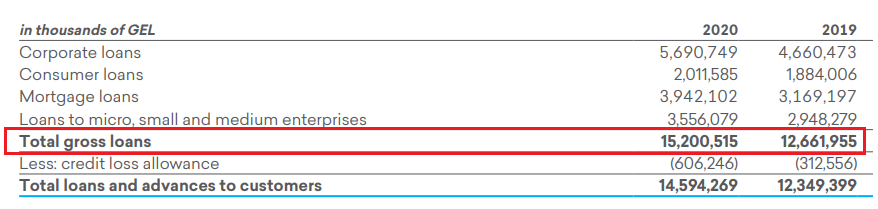

The values of the gross loan portfolio, as a rule, are reflected in the notes to the financial statements of the bank. For example, in the reporting of the Georgian

TBC Bank, the gross loan portfolio is indicated under the name “Total gross loans” in the notes to the statements.

If we talk about local standards, then, for example, the loan portfolio of Russian banks can be calculated on the basis of reporting form No. 101, “Statement of Accounts of Credit Institutions,” according to which credit institutions report to the

Bank of Russia. In Russia, the Central Bank calculates indices on bank loans to

legal entities and

individuals, with the help of which it is possible to obtain data on the aggregate loan portfolio of banks.

In practice, the following types of bank loan portfolios are distinguished:

1) The optimal portfolio that is most consistent with the bank’s strategy and its credit policy.

2) A balanced portfolio, which is characterized by the correct ratio of risk and return. This means that the bank can issue loans at lower rates and with increased risks to attract new customers.

3) A risk-neutral portfolio, which is characterized by low risks and a low level of profitability.

4) A risky portfolio that has a high level of risk and high profitability.

Bond Screener

Watchlist

Excel add-in

API